Background

Some of credit unions' biggest competitors in auto lending are dealerships and auto finance companies such as Toyota Motor Credit, Honda Finance, and Ford Credit. Although credit union rates are usually lower, dealers have the ability to buy rates down, beating already low credit union rates.

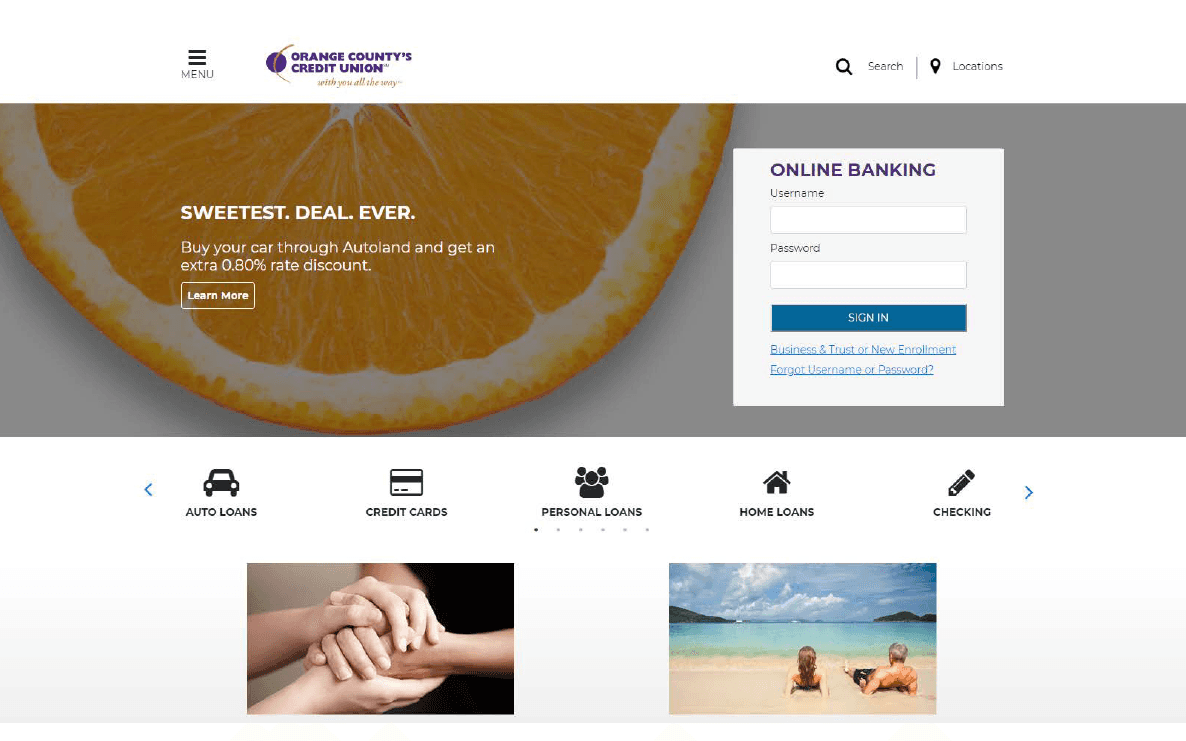

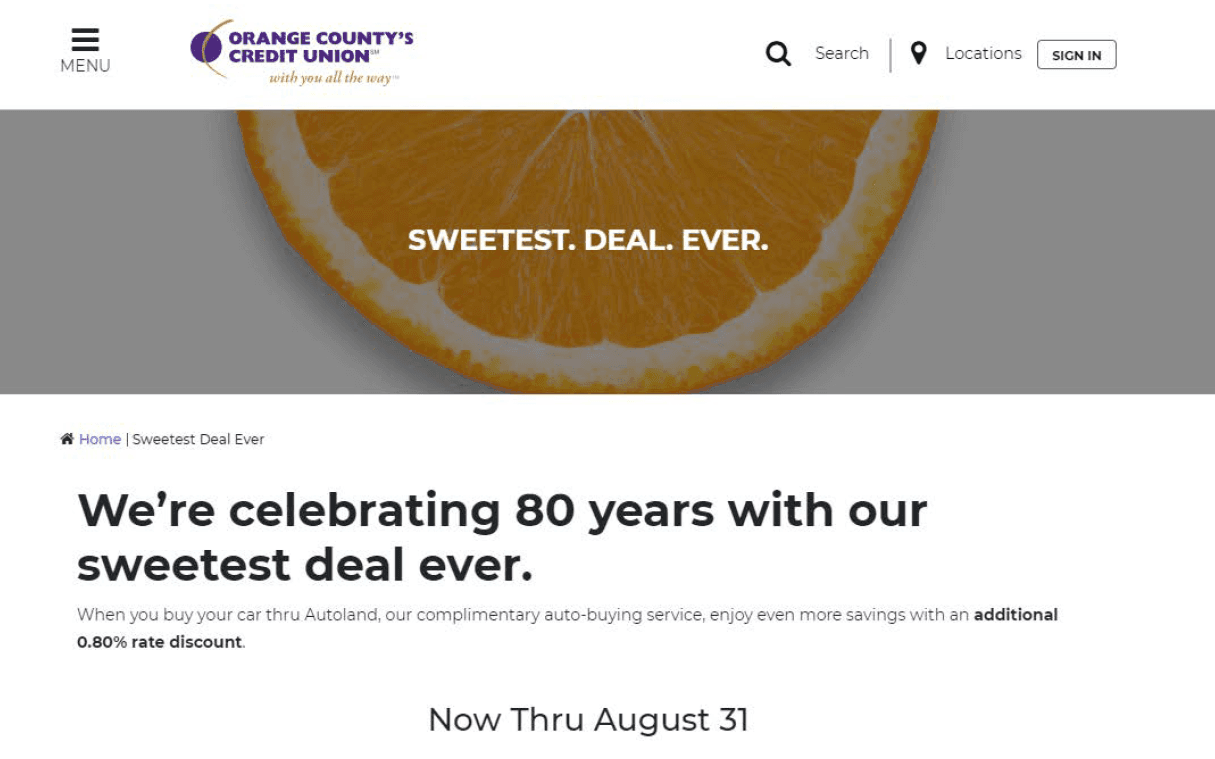

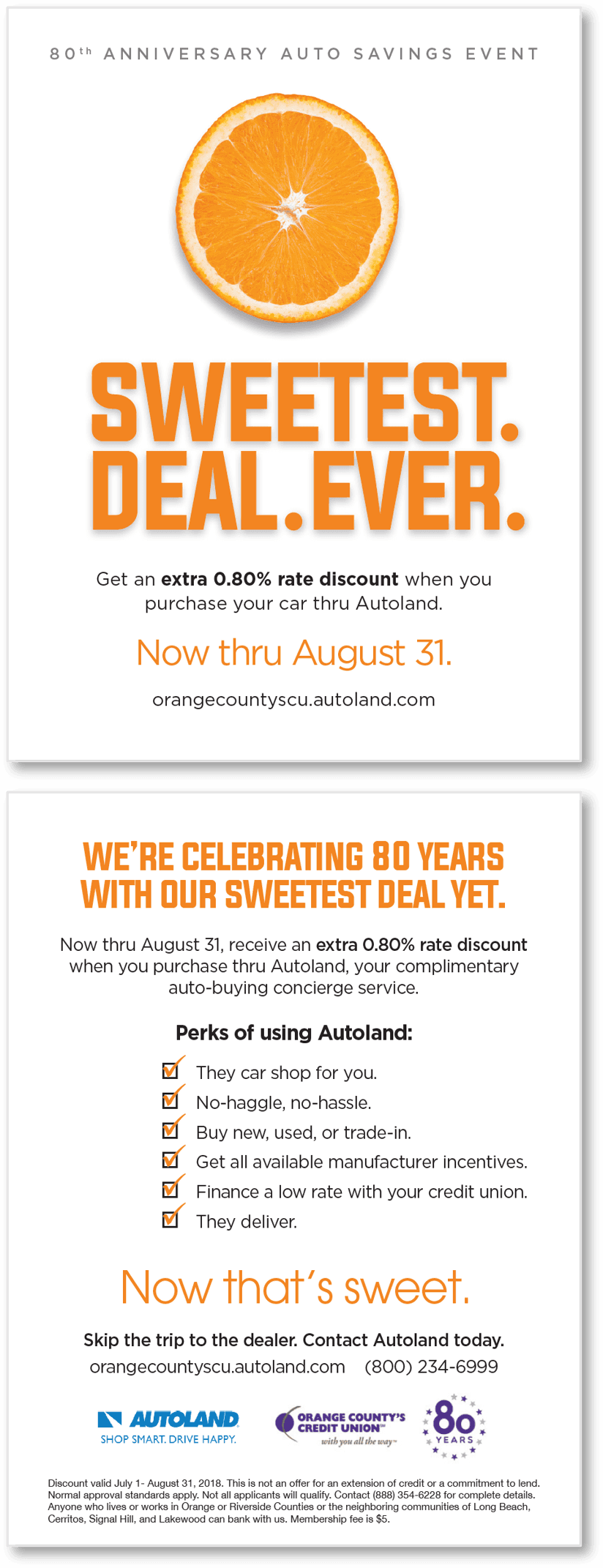

Orange County's Credit Union partnered with Autoland for July and August 2018 to offer a rate reduction for Members who purchased their car through Autoland. The Credit Union wanted to highlight this reduced rate as an incentive for its Members to jump-start the quarter.

Process

At this time, the Credit Union had given its branches a branding refresh with a clean, fresh look that was simple but inviting. We wanted to stick with a minimalist look that complemented the refresh. As a part of the creative process, we looked to trending marketing campaigns outside the finance industry for inspiration, including fashion, jewelry, and home décor. We quickly discovered that fruits were the theme and a popular focus on numerous marketing pieces from these industries.

That’s when it hit – sweet. Fruits are sweet. Our reduced rate was sweet. And so SWEETEST. DEAL. EVER. was born. After a number of small focus groups showcasing ad mock-ups with a variety of fruits, it was a single orange that won. It was simple, bright, and had an additional tie-in with Orange County’s Credit Union.

Results

A multi-channel campaign was created to reach the most amount of Members and non-Members. Media types included:

Branch Posters

Flyers

Name Tag Badges for Front-Line Associates

Statement Attachment

Statement Ads

In-Branch Display Screens

Online Banking Login Prompt

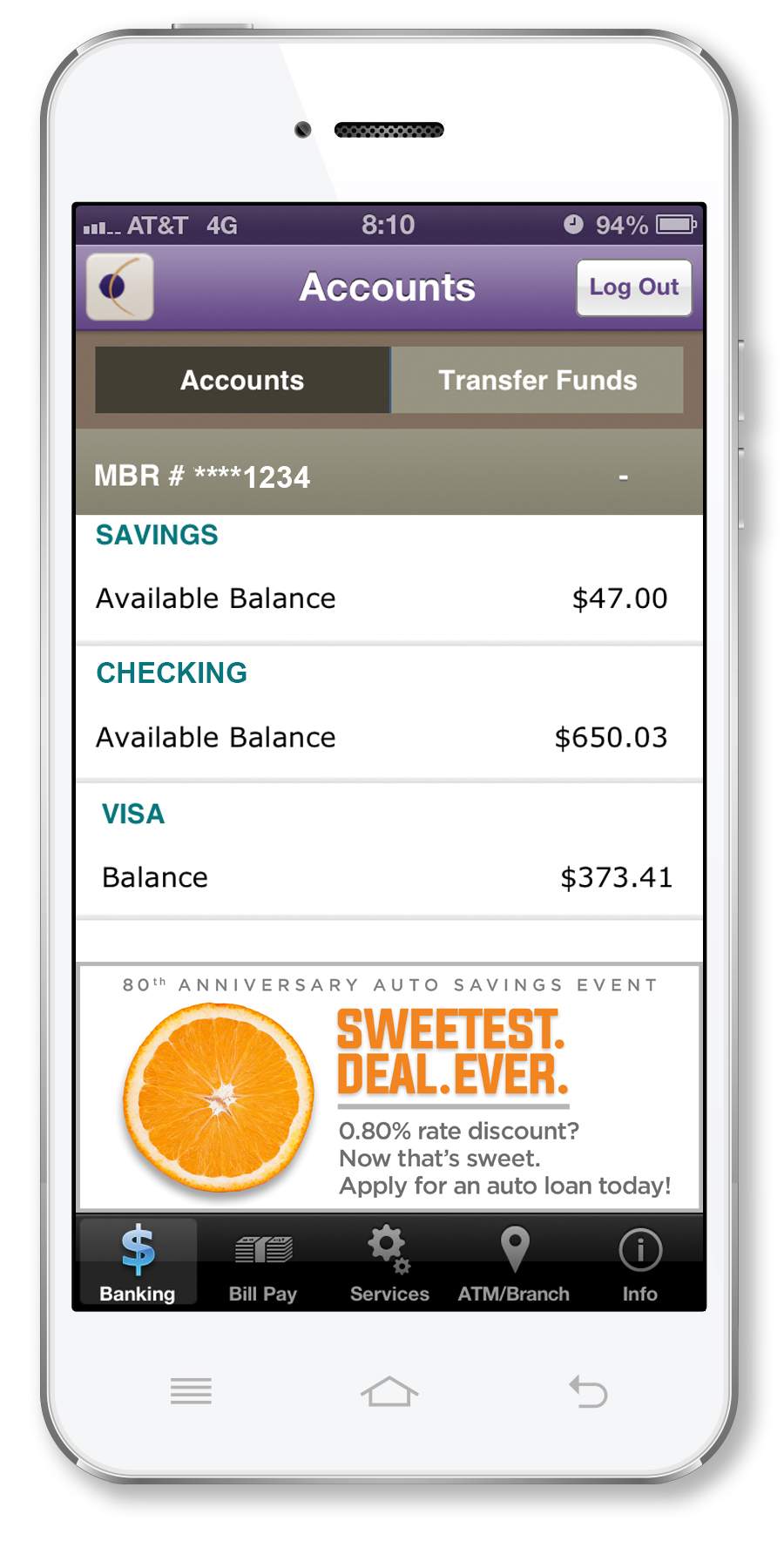

Online and Mobile Banking Ads

Website Home Page & Landing Page

Marketing Emails

Receipt Messages

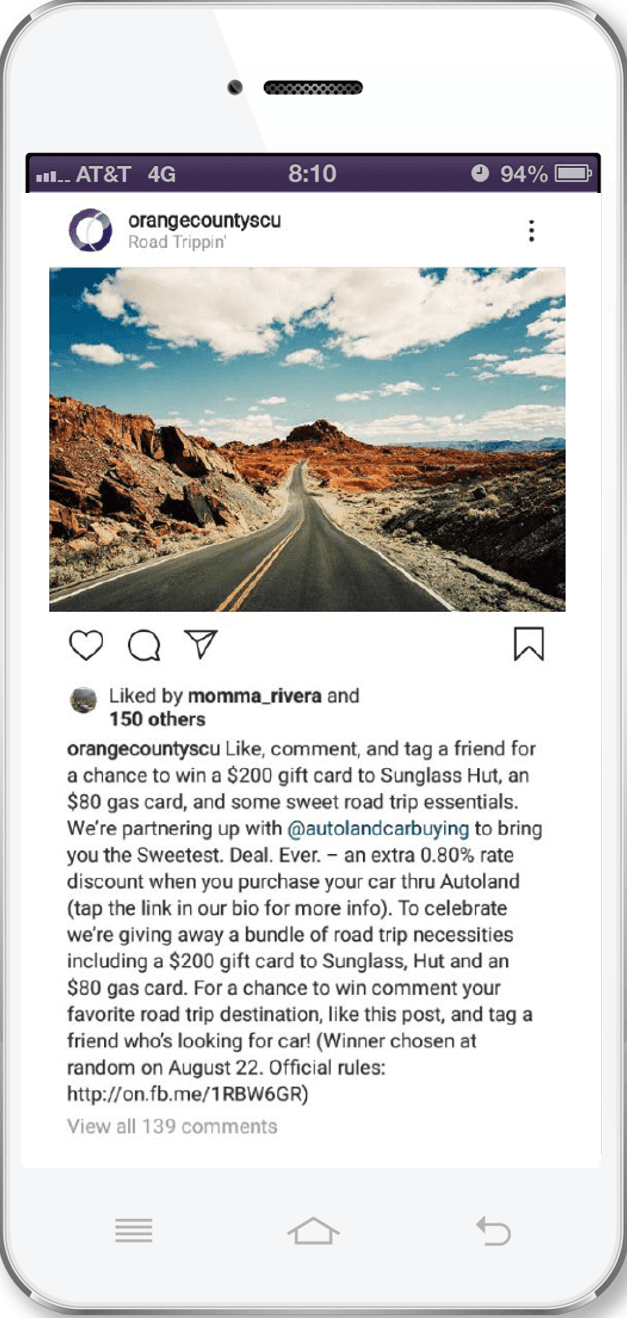

Social Media

The campaign was the most successful auto loan campaign to date in regard to loan growth. It was also the first time the Credit Union implemented a partnered giveaway on social media, resulting in the top social content piece for both Instagram and Facebook.

37.67%

over marketing goal ($28.2M vs. $38.8M)

+43.07%

YoY increase in new loan balances ($27.1M to $38.8M)

1,303

clicks on mobile and online banking ads - the most mobile and online banking clicks than any other auto loan campaign prior

#1

content piece for both Instagram and Facebook in impressions, engagements, and click-throughs